LETTERS FROM THE GLOBAL PROVINCE

Unplugged, Global Province Letter, 30 June 2010.

Unplugged. We listen to Eric Clapton’s Unplugged album most everywhere—in the car, out in the yard while tending the hibiscus, in the stuffed upholstered chair while diving into the latest witty Inspector Montalbano mystery, The Wings of the Sphinx. Frankly we don’t care if Clapton is plugged in or unplugged (without electronic modification and amplification), since he sounds great either way, to our untutored ear. Perhaps Tears in Heaven does seem a trifle more pure or angelic without all the electronics, but we welcome, just as much, the demonic strains of highly chaotic music about which John Milton railed in some of his verses.

Unplugged. We listen to Eric Clapton’s Unplugged album most everywhere—in the car, out in the yard while tending the hibiscus, in the stuffed upholstered chair while diving into the latest witty Inspector Montalbano mystery, The Wings of the Sphinx. Frankly we don’t care if Clapton is plugged in or unplugged (without electronic modification and amplification), since he sounds great either way, to our untutored ear. Perhaps Tears in Heaven does seem a trifle more pure or angelic without all the electronics, but we welcome, just as much, the demonic strains of highly chaotic music about which John Milton railed in some of his verses.

What’s important is not this ironic ‘unplugged’ turnabout of very plugged-in MTV, which sponsored this Unplugged Series. It is the symbolism of unplugging that arouses our interest. In music, in healthcare, in banking, in government, in just about everything, we have encumbered ourselves with profitless complexity which is inherently flawed and manically unstable. Norm Augustine even ginned up some laws that explained how things work worse and cost exponentially more as we fill them up with electronics and bad engineering. Mis-firing and bad wiring about sum up our society’s present predicament. At every turn we are plugged into systems that distort our lives and our pocketbooks. Time for some circuit breakers.

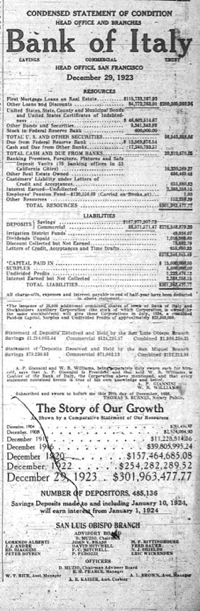

Amadeo Giannini’s Bank of America. Like it or not, and most of us do not like it, we are all plugged into the big money center banks. We have to use them for one thing or another, at our peril. With perhaps one or two exceptions, they are all demonstrably unsound. Scale has been the enemy of quality. As good an example as any is the Bank of America, a lumbering mess and a far cry from the colossus put together by Giannini in the 1920s. For sure it has absolutely no connections with its roots in California and Italy. It is bad enough that its strategy has been flawed for years. But, as importantly, it is simply badly run.

Amadeo Giannini’s Bank of America. Like it or not, and most of us do not like it, we are all plugged into the big money center banks. We have to use them for one thing or another, at our peril. With perhaps one or two exceptions, they are all demonstrably unsound. Scale has been the enemy of quality. As good an example as any is the Bank of America, a lumbering mess and a far cry from the colossus put together by Giannini in the 1920s. For sure it has absolutely no connections with its roots in California and Italy. It is bad enough that its strategy has been flawed for years. But, as importantly, it is simply badly run.

We like to cite a simple example. You can pay off your credit card balances at any of its local branches. But should a clerk put the wrong amounts of money in the wrong accounts, the branch manager cannot reverse his errors in the days that follow. That has to be done by some distant chaps in a credit card division which can take 5, 10, or 15 days to fix the simplest errors, errors which often penalize the customer. The errors, in other words, cannot be corrected by the people who made them. We listened in bemusement as a smart lady banking manager laboriously tried to straighten out some factotum at credit card central a few months back.

For years Bank of America had gobbled up other companies, even though Peter Drucker could have warned it a decade or so ago that mergeritis was a dead end. It could go down this blind alley because of the reckless policies of Alan Greenspan’s Federal Reserve, in what may be the blackest period in the central bank’s history. The Fed’s loose money and looser regulation created a hydrogen-filled balloon ready to burst into flames, and it and the Treasury later funneled yet more cash to the banks to save them from certain collapse during the financial meltdown in the last days of the Bush Administration.

What’s worse is that now, post-crash, we have even greater market concentration in the banking industry, with even fewer big dominant players, even though neither their operations nor their strategies have been overhauled. The banks talk a great deal about their financial innovations over the last 50 years, but mostly these have been schemes that have gone awry. Paul Volcker, the very responsible Fed Chairman from 1979 to 1987, has pretty much said that the only financial innovation he’s seen in the last 30 years that’s worth a darn is the ATM. The banks owe their existence to government subsidies, not to their competitive energy or business sagacity or inventive dispositions.

The banks dramatically illustrate that our economy is a house of cards. If, in fact, we netted out 30 years of phoney financial service activities such as securitization, we would find out that our GNP has been at a standstill for a quarter of a century. We are hard pressed to name a large institution of any sort that is operating right and whose survival is not imperiled. This is the dilemma we must face in business, in our investments, and in our lives. How do we deal with a world financial system that is now inherently unstable and an assortment of very large institutions (business, academia, government, etc.) that are, one and all, sclerotic?

Ergo, unplugged. In our next investment advisory, we will be suggesting that you get unplugged. Invest in companies and sectors that shy away from the madding crowd.

Around your home, we would counsel you to get unplugged. It’s not a bad thought to have a natural gas-fired generator (perhaps a Generac) at the ready, because we will probably have more frequent massive power interruptions. Our weak power grid and over-sized, centralized utilities guarantee ongoing problems. As we tire of the mediocre offerings of our domestic radio and TV networks, we can think about internet radio, probably bought from Grace Digital Audio or some other new, small provider, since the large appliance companies charge too much for too little. It permits us to tap into media around the world, transporting us beyond the pablum on our own airwaves. The banks having failed us, one must consider credit unions and other financial intermediaries that are more reliable. We must find alternatives that unplug us from existing, glitch-filled systems.

Another Road. A brilliant constitutionalist, back in 1689, Sir John Maynard, summed up what his England must do to fully implement the Glorious Revolution of 1688, advice then that applies as well to the present day. One commentator remarks on him thus:

Another Road. A brilliant constitutionalist, back in 1689, Sir John Maynard, summed up what his England must do to fully implement the Glorious Revolution of 1688, advice then that applies as well to the present day. One commentator remarks on him thus:

The resulting Convention of Lords and Commoners was equally efficient. Its dominant policy of disregarding historic precedents in order to face immediate needs was expressed by a lawyer ninety years old, Sir John Maynard. Endeared to lawyers as the first editor of the Year Books, an invaluable record of court proceedings under the Plantagenets, Maynard had sat in the Long Parliament and been one of Strafford's accusers in 1641. Now he spoke out of his long wisdom:

“We are at the moment out of the beaten path. If therefore we are determined to move only in that path, we cannot move at all. A man in a revolution resolving to do nothing which is not strictly according to established form resembles a man who has lost himself in the wilderness, and who stands crying ‘Where is the king's highway? I will walk nowhere but on the king's highway.’ In a wilderness a man should take the track which will carry him home. In a revolution we must have recourse to the highest law, the safety of the state.”

At the present moment, in every domain, we are trying to get on the king’s highway, putting both our state and our economy in peril. We are dragging along the baggage of the 20th century. Until that time when we see more attempts to create wholly new systems, rather than doomed attempts to patch up those that are broken, the thoughtful citizen should break free of the herd and strike out in his or her own direction.

P.S. We first commented on our world of broken systems back in 2002 in an essay entitled “Systems on the Edge of a Nervous Breakdown.” Unfortunately the roosters have finally come home to roost.

P.P.S. A teacher, one Anthony Pitucco, wanted to unplug recently, because he felt he could do a more effective job with simple equipment—a blackboard, chalk, and an eraser. Of course, he was forced to use everybody’s bête noire—PowerPoint, because simple and sweet was just not available. The equivalent situation, we suppose, occurs in hospitals where doctors prescribe an endless ream of tests but somehow just don’t do a careful physical examination of their patients. Gadgets and automation have run amuck. Expensive medical apparatus has overwhelmed medicine itself.

P.P.P.S. The Obama Administration has, amazingly and at tremendous political cost, pushed through a horde of legislation—healthcare insurance expansion, stimulus spending, bank reform, etc. But history will probably say that its bias was towards big—towards big institutions, big banks, big businesses, etc. The empires the Government has propped up unfortunately continue to be the source of our ongoing chronic ailments. By and large, the legislation does not get us where we need to go.

P.P.P.P.S. Leaders worldwide have to deal with an economic conundrum that is much worse than anything the Great Depression presented. That is, they must work toward tight money in order to put the world’s financial house back in order and to get excessive leverage out of our affairs. But they must also put people to work, which means flooding the system with cash. Damned if they do. Damned if they don’t. George Soros just spoke about this in Germany on June 23, and Germany, of course, has not learned how to strike the right balance between these two conflicting demands. Paul Krugman thinks this all adds up to a long depression, but not a Great Depression.

P.P.P.P.P.S. Some perverse part of our nature compels us to subscribe to Wired, a provocative magazine that is poorly edited and horribly designed. We know of no other magazine that is as reader unfriendly, though several others, in the hands of runaway designers who don’t read anyway, are close runner-ups. If this is what it means to be ‘wired,’ we are confident that we should all get unwired.

P.P.P.P.P.P.S. Eric Clapton just staged his 3d Crossroads Guitar Festival at Toyota Park, just outside Chicago. Fortunately, we can say, the band plays on, even if rappers would drown it out.

P.P.P.P.P.P.P.S. One of our readers reminds us that Canada, curiously enough, did not let its banking go astray. One can read about this in “Canada: Land of the Free,” Wall Street Journal, June 26-27, p.A.ll. Of course, Canada’s small population and large store of natural resources have insulated it from some of the world’s turmoil.

Home - About This Site - Contact Us

Copyright 2010 GlobalProvince.com