LETTERS FROM THE GLOBAL PROVINCE

Life After Death, Global Province Letter, 4 August 2010

“Of all the thirty-six alternatives, running away is best.” Chinese Proverb

“The Matrix is a system, Neo. That system is our enemy. But when you're inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system, that they will fight to protect it.” – Morpheus, The Matrix

The World Askew. When the Founding Fathers launched these United States back in 1776, a goodly number of them trucked with Deism. Ben Franklin, George Washington, Thomas Jefferson, and even John Adams were thought to have flirted with its precepts. That is, they held that their god had set the natural world, as we know it, in motion, sort of heaving it like a bowling ball from the heavens to the solar system, and then sat back in bemusement to see what mankind would do with it. He was sort of a benevolent, hands-off parent who provided a garden of riches and then patiently waited to see how his children would realize their potential:

Deism became prominent in the 17th and 18th centuries during the Age of Enlightenment, especially in what is now the United Kingdom, France, United States and Ireland, mostly among those raised as Christians who found they could not believe in either a triune God, the divinity of Jesus, miracles, or the inerrancy of scriptures, but who did believe in one god.

Deists typically reject most supernatural events (prophecy, miracles) and tend to assert that God (or "The Supreme Architect") has a plan for the universe that is not altered either by God intervening in the affairs of human life or by suspending the natural laws of the universe. What organized religions see as divine revelation and holy books, most deists see as interpretations made by other humans, rather than as authoritative sources.

For a couple of centuries the nation rocked along pretty well, apparently free of divine intervention, mostly ruled by its citizens’ reason and morality. But in the late 20th century it began to spin out of orbit, and now it is bouncing violently to and fro, with irrationality and fanaticism in the saddle. We anticipated this present state of affairs in our letter “Systems on the Edge of a Nervous Breakdown.” There is virtually no major institution in our society—government, academia, business, church, etc.—that is running well and bettering our society. Gridlock has affected more than Congress and our claustrophobic urban streets: it is the state of the nation. It is not an exaggeration to say that the country created by the Deists in 1776 no longer exists, and a new America must emerge.

Long if not Great Depression. Understanding the apocalyptic state of our world is necessary prologue to any discussion of investment strategy. Our governance and our banks are messy enough that we are forced to buy into the prediction of one economist who says, “We’re in a depression, not a great depression, but one that is bound to go on for a decade. It will drag on.” We would not bring all this up in the dog days of what promises to be an extra-hot August, except that it means that, as investors, we have to get off our duffs today and look for investments in what  have traditionally been all the wrong places. Now is the time to put money where angels fear to tread.

have traditionally been all the wrong places. Now is the time to put money where angels fear to tread.

The immediate causes of our breakdown are a global financial system that is diseased and broken, and a national government that is in paralysis. The Clinton and Bush Administrations totally missed their call to greatness and frittered away great opportunity. Our court system regresses instead of progressing. We know our Congress to be in gridlock. History does tell us we’re in for bad times because we have a government that is unstable and is not governing. Good government is the sine qua non of prosperity.

Only a very few nations have reined in their banks. Most banks, here and abroad, have fallen back into shell games, bad habits, and all the deviousness that netted us 9% unemployment in the first place. Onetime Fed Chairman Greenspan’s pronouncement on the state of our financial mishmash has been widely reported: “Former Federal Reserve Chairman Alan Greenspan said the financial crisis was “by far” the worst in history and called the recovery from the global recession “extremely unbalanced.”” We guess he should know since he had a major hand, both inside and outside these United States, in putting us into such financial shambles.

The system needs to be repaired on two fronts. That is, the patent dishonesties have to be rooted out, and financial executives must be threatened with criminal penalties for the most grievous offenses. But, as much, the system is vastly swollen, churning out a host of instruments and transactions that are not needed and creating a bulbous mountain of bogus financial activity. We would hazard a guess that there has been little or no GNP growth in the U.S. for 25 years, if one nets out the financial puffery. In fact, featherbedding in the financial services industry far outweighs and is far more detrimental to our health and welfare than the much talked about padded payrolls of our governments.

The fluff needs to be eliminated so that the resources freed up can be used to build a real economy. No dean of finance has been brave enough to suggest that we need to slice out garbage banking, although ex-Fed Chairman Volcker has at least hinted that most of the financial innovations of the last 40 years have been for naught. We probably will not see the end of our current depression until such time as we have major constitutional reform and we have regeared our banking system, asserting decent government control over it. The recent financial reform bill did not get the job done.

Escape the Thundering Herd. Both individuals and institutional portfolio managers have pretty much invested as they always have, even after the financial chaos in the last stages of the Bush Administration. Those we advise still pray that the volatility will go away, and that life will revert to the ‘old normal.’ The great mass of investors thinks it is business as usual. It ain’t.

Even contrarians who are suppose to bet against current notions and trendy thinking turned out to be rather conventional during this bloodbath. Contrarians tend to go their own way to get some traction until they get a little money in their pockets: then they behave like the rest of us. All sorts of investors did exceptionally well for quite a few years. As a consequence, most everybody followed the herd over the cliff during the 2008 meltdown. Everybody took a 30% hit (or worse) in the last quarter of 2008.

A few parked some cash in the banks. Institutional investors often used Goldman as their depository during the crash, mistakenly considering it a safe, reliable haven. But for the Obama bailout, they would have lost a good portion of their liquid assets.

Meanwhile, even the value of cash has been shrinking. That is, the U.S. currency is suffering a long-term decline in value, as world markets ruminate about the weakness of our economy and our ever- troublesome foreign trade deficits.

The best of the best investors got their skirts muddy, just like the rest of us. David Swensen of Yale, renowned for a spectacular performance for so many years, based on his push into private equity and alternative investments, was locked into stuff that still has not completely recovered, a fate also suffered by the chaps up at Harvard. Swensen, so successful, even wrote a couple of books laying out his wisdom for the rest of us, which was probably a warning sign that he was about to get in trouble. We would suspect, in fact, that his investments were not diverse enough, since he, too, listened to the smart fellows in Wall Street everybody else admires.

Once again, it’s terribly important to pay heed to a chastened Greenspan. This was and is our worse financial crisis ever, and it is not going away soon. It is unprecedented. Now the economists are likening the tremors in our financial markets to earthquakes:

Macroeconomists construct elegant theories to inform their understanding of crises. Econophysicists view markets as far more messy and complex — so much so that the beauty and logic of economic theory is a poor substitute. Drawing on the tools of the natural sciences, they believe that by sorting through an enormous amount of data, they can work backward to find the underlying dynamics of economic earthquakes and figure out how to prepare for the next one.

“If you analyze them, this earthquake law is obeyed perfectly,” notes H. Eugene Stanley, a Boston University physics professor who published a pioneering study of financial markets in the scientific journal Nature. “A big shock causes smaller aftershocks, and then ones smaller and even smaller.”

We suspect, moreover, that the turmoil in our markets is a bit more puzzling than earthquakes. The complexity and chaos theories studied out at the Santa Fe Institute would better explain the phenomena we are encountering.

What 2008 told us and what the present moment tells us is that no investor, small or large, can sit on his hands. There is no safe port in this storm. One has to think very creatively about where to find little oases of value that have escaped mainstream investors and are selling for much less than their intrinsic worth. What one is looking for is deep, deep value that’s unlikely to get wiped out. Often it is value that the accountants cannot put on a company’s balance sheet. It’s time to look for values in unexpected places. Here are some illustrations:

1. Valuable Bankrupts. Early in March 2009, an investor could have bought Wells Fargo Bank for $9-11 a share. Today it’s selling for $27 and change. It’s neither badly run nor well run. As many banks in the tremulous period of 2009, it could have slid into receivership but for the bailout orchestrated by the Obama Administration (and some members of the Bush Administration). It was a buy, not because it had a wonderful, scandal-free balance sheet or huge, wonderful prospects, but because the Government was there to pump it up. In other words, one should look for companies that are hurting or in a stall, but then buy into them because the Government is going to subsidize them.

Chances are that there will be other companies outside the banking and automobile sectors that the Government will underwrite. In other words, one can make a whole lot of bets on Uncle Sam.

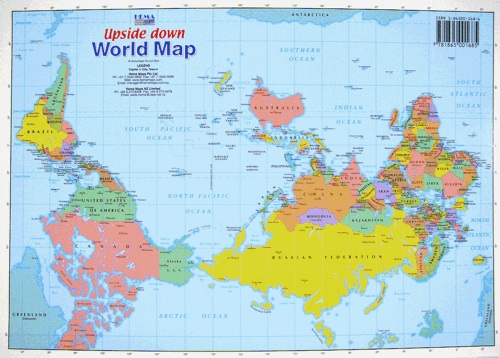

2. International Growth. It’s a truism these days that one should look to invest abroad, particularly in Asia. Yet many of the international mutual funds have turned in tepid results at best. Quite often the published accounts for companies in the Far East are questionable, and one can fall flat on one’s face investing there.

Nonetheless, the biggest players know that they have to cross the water. George Soros, the speculator par excellence, has made a great deal of money on currency plays. Warren Buffett, who resolutely tells us all to Buy American, now has put a stream of assorted foreign foodstuffs in his diet. For a while he was a major owner of PetroChina.

But less knowledgeable investors can safely make money with companies that are betting on the poor in poor countries. Such a company is Danone that is selling yogurt, water, and baby food for 10 cents a portion to the impoverished in a host of countries. Formerly it only sold to a narrow band of well-heeled customers in the rich countries: now it is trying for a billion customers by 2012.

C.K. Prahalad, the management guru who instilled the concept of core competencies in us, broadcast a much more valuable idea to us before his death. As we suggested in our 2005 Annual Report on Annual Reports, he told big multinationals that there are many nickels to be made in poor developing countries. Indeed, the major markets of countries in the most developed markets have stalled, and we must pay special attention to the companies that are smart enough to go where the growth is. In this vein, it is truly remarkable that China has become a more important market for General Motors than the United States. There are a significant number of companies that are now coining money in unexpected places.

3. Intellectual Capital. Other companies are sitting on top of unrecognized pots of gold. BioSpecifics is one. It doesn’t make anything. It does not have much in the way of assets. It just owns an idea (patent rights around collagenase) that alleviates skin problems and external irritations that cause a fair amount of suffering. At the beginning of November 2006, one could have bought a share for $2 or so. Today it is just about $24. It has licensed its technology to a partner that is just bringing to market a drug to treat Dupuytren’s Disease.

Look for intellectual capital on the cheap at small companies. R & D at most large companies is slipshod and often unproductive. In fact, our largest drug companies are in crisis, since their product pipelines are so thin.

Samurai Rice. “Every year since 1993, villagers have created pictures by using rice paddies as their canvas and living plants as their paint and brush.” “Last year, more than 170,000 visitors clogged the narrow streets of this quiet community of 8,450 mostly older residents, causing traffic jams and waiting for hours to see the living art.” In Inakadate, Japan, just a couple of weeks ago, onlookers enjoyed “a samurai battling a warrior monk.” Inakadate “has fallen on hard times from a shrinking population, a crushing debt load and declining revenues from agriculture.” It may live again if it can pick the pockets of the many tourists it now draws to its rice paddies.

Samurai Rice. “Every year since 1993, villagers have created pictures by using rice paddies as their canvas and living plants as their paint and brush.” “Last year, more than 170,000 visitors clogged the narrow streets of this quiet community of 8,450 mostly older residents, causing traffic jams and waiting for hours to see the living art.” In Inakadate, Japan, just a couple of weeks ago, onlookers enjoyed “a samurai battling a warrior monk.” Inakadate “has fallen on hard times from a shrinking population, a crushing debt load and declining revenues from agriculture.” It may live again if it can pick the pockets of the many tourists it now draws to its rice paddies.

Villages across Japan are dying, along with the nation’s rice culture. It is fascinating to see fire in the ashes, signs of life where atrophy and sadness seem to rule the day. Here lies both the challenge and opportunity for investors. To find riches where others see nothing but a wasteland. To go where nobody wants to go.

In unusual, hard times, value is created in strange, new ways by people who are up against it. The task for the investor in a world of volatile, straitened circumstances is to be creative enough to root out value that may not be immediately apparent to provincial investors in the world’s financial fortresses who walk with blinders on and run with the herd.

P.S. Agricultural tourism has also taken root in America. Locals here, like the Japanese, have had a hard time figuring out how to cash in on their tourists.

P.P.S. The Bretton Woods Conference in 1944 established a world monetary regime that brought prosperity to the more developed nations of the world, lasting until the 1970s. Since then our global monetary system has been an unsatisfactory patchwork affair.

P.P.P.S. A prudent investor, as opposed to the day trader or speculator, had best know that most of the statistics so ponderously cited by economists and pundits are just plain flawed. One good way to get a fix on things is John Williams’ Shadow Government Statistics. For instance, look at his view of our real GDP.

P.P.P.P.S. Goldman often acts too much like the 2d Bank of the United States which Andrew Jackson had to plough under. It has often confused its public obligations with its personal quest for lucre. Far too many of its ex-officers have been given a role in Government, most dangerously as Secretary of the Treasury. Even the sometimes-reviled J.P.Morgan better defended the nation’s interests than the partners at Goldman. Warren Buffett has lost some of his own golden reputation defending this tarnished institution.

P.P.P.P.P.S. Every serious investor should consider getting the free newsletter, or better yet some of the paid materials, from the folks at BankruptcyData.com. They provide all sorts of interesting information for the informed investor, such as monthly tabulations of corporate bankruptcies. For instance, they spotted “13 public companies file for bankruptcy in July bringing the year-to-date total to 65.”

Company Name |

Bankruptcy Start |

Industry |

Filing Type |

07/30/10 |

Banking & Finance |

11 |

|

07/29/10 |

Energy |

7 |

|

07/27/10 |

Other |

11 |

|

07/23/10 |

Telecommunications |

11 |

|

07/22/10 |

Banking & Finance |

11 |

|

07/19/10 |

Real Estate |

11 |

|

07/18/10 |

Retail |

11 |

|

07/12/10 |

Healthcare & Medical |

11 |

|

07/12/10 |

Hotel & Gaming |

11 |

|

07/09/10 |

Chemical |

11 |

|

07/09/10 |

Heath Care & Medical |

11 |

|

07/02/10 |

Healthcare & Medical |

11 |

|

07/01/10 |

Publishing |

11 |

Home - About This Site - Contact Us

Copyright 2010 GlobalProvince.com