|

40. Taiwan's Fubon Financial Acquires Stake in

China's Xiamen City Commercial Bank

ChinaVest

April

08

|

|

ChinaVest

has reported on developing trends between Taiwan and China. Huge growth

opportunities in China are being driven by Taiwanese companies and

entrepreneurs operating there despite restrictions on Taiwanese direct

investment. But winds of political change are gathering momentum. In less

than two weeks following the China-friendly

|

|

Kuomintang

Party's Ma Ying-jeou becoming President of Taiwan, Fubon Bank's plan to

invest US434 million in Xiamen City Commercial Bank received the the

blessing of the Taiwan's top financial regulator. The removal of the ban

on Taiwanese banks directly investing in mainland China banks will no

doubt create further opportunities.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

39. The Changing Private Equity Landscape in China

ChinaVest

14 March

08

|

|

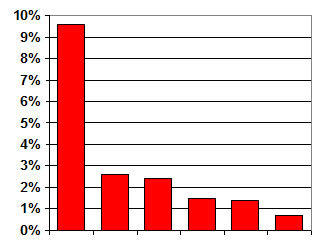

Dynamic

changes have taken place within the Chinese investment landscape since

ChinaVest launched its first institutional investment fund in 1983. The

seeds of change were planted in the 1980s by Deng Xiaoping via the

creation of Special Economic Zones located in proximity to Hong Kong. But

events quickly gathered momentum when China joined the World Trade

Organization in 2001 and the central government began to sell off assets

and create a regulatory system. A flood of foreign private equity found

Chinese firm’s desperate for capital; private equity/venture capital money

poured into China at a compound annual growth rate of 134% from 2002

through 2006.

But Chinese

regulators have evidenced wariness at the trends. Due to nationalistic

pride, concerns of social unrest due to potential layoffs and bulging

Chinese coffers, obstacles to foreign investment are emerging. Certain

industries, including banking and airlines, have strict limits on foreign

ownership while others require approvals from complex combinations of the

central government and industry regulators. There have been notable

examples of failed deals, including Goldman Sach’s planned investment in

Fuyao Glass.

Despite

rising hurdles, look for growing levels of private equity investment in

China. The country is

|

|

somewhat insulated from

the developed world’s economic malaise and private investment relative to

GDP is at very low levels. New creative investment strategies will help

spur private investment, “including bridge loans, PIPE deals (when private

equity firms acquire stock in public companies) and mezzanine financing

(convertible bonds and other quasi-equity financing).”

Further

creativity will be required, as a rise in domestic/local private equity

funds from zero just a few years ago to 12 today provides a newly

developing competitive threat to foreign investors. And regulations

requiring deals be done in the renminbi will make it more difficult for

foreigners. Industrial Development and International Domestic funds, both

deemed to be Chinese investment vehicles, are also being encouraged by the

Chinese government.

“China’s

private equity market will remain vibrant in 2008.” But the landscape is

changing such that foreign investors will increasingly find themselves

disadvantaged relative to local investment pools. There are, however,

dangers to the Chinese economic system of putting “too much emphasis on

the local private equity”, and countless millions of entrepreneurs have

created an “economic juggernaut, an inertial force unparalleled in modern

history.”

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

38. ChinaVest Publishes Weekly Investment Trends

Newsletter

ChinaVest

Oct 07

|

|

ChinaVest

has leveraged its research capabilities to publish a weekly newsletter

that provides a comprehensive look at all of the latest events in China,

including reviews of general economic

|

|

news, IPOs and M&A activity. For past issues, please visit ChinaVest’s

Research Library.

To sign up to receive the weekly letter via email, visit its

signup page.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

37. Merchant Bank Activities

Oct 07

|

|

Entries

after 2002 refer to the Merchant Bank based in Shanghai, and not to the

private equity ventures which are part of an entirely separate

|

|

organization. For a short history of merchant banks, consult

Merchant Banks.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

36. Forbes interviews Robert Theleen on changing investment trends in China

Capital Markets & Investing; China's new model

Forbes.com; by Andrew Tanzer

23 Dec 02

The full

article is only available in Forbes print edition.

|

|

Mr. Robert Theleen has witnessed major changes in China's business

environment over the last several decades, both as a consultant to

multinationals and as founder in 1983 of the first private equity investment

company to target China, ChinaVest. Originally, ChinaVest ignored

conventional western perceptions of China as a consumer market by following

overseas Chinese entrepreneurs into China who viewed China as a producer.

Zindart, a Nasdaq-listed (ZNDT)

manufacturer of die-cast collectibles and pop-up books, remains a ChinaVest

portfolio company.

Since its founding, ChinaVest has grown to manage $300

million. Investment in early-stage companies normally runs between $2

million to $5 million. With more mature investments, ChinaVest is willing

to pony up between $5 million and $15 million. Despite setbacks,

ChinaVest's "funds internal rates of return have averaged close to 25%,

which would place them in the top quartile of Silicon Valley VC funds."

Last year, ChinaVest sold its stake in Alphatop, a maker of Macintosh

laptops, after tripling its $3.5 million investment in just two and a half

years.

The next wave of investment consisted of native Chinese returning with

foreign education and work experience. Ironically, the Tiananmen Square

incident in 1989 propelled this trend, as many Chinese found themselves

stranded overseas. ChinaVest supported several such returning

entrepreneurs, including AsiaInfo

(Nasdaq: ASIA) -- proprietary telecom software

|

|

for building out China's Internet, NewTone --

telecom-switching software, and

Medio Stream -- video-compression software.

Now, Theleen is looking to "homegrown entrepreneurs" from Chinese Universities, "a hotbed

of entrepreneurism and a center for intellectual creativity." ChinaVest

acquired a 20% interest for $3 million in

ServGate Technologies, an

Internet security company that drew on technology developed by Beijing's

Tsinghua University.

ChinaVest is investing beyond technology and telecom into logistics,

distribution, and branded consumer goods and services. Linking producers

and consumers is a key to developing China as a national marketplace, a

view Theleen calls "China horizontal." ChinaVest portfolio companies

targeting logistics and distribution include

Tait Asia, CV Global

Logistics, and Chic

Logistics.

ChinaVest also holds franchises for Domino's Pizza and TGI Friday's, and

it will be rolling out China's first foreign radio station in conjunction

with Richard Branson's Virgin Radio. Theleen expects the 2008 Olympics to

help introduce China's branded products to the world community. Branding is

also expected to get a boost from younger entrepreneurs who aren't as tied

to family control.

Theleen comments that a key issue for venture capitalists in China is

developing exit strategies. But from a macro economic perspective,

"building a modern banking system is the leading challenge facing economic

planners."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

35. Michael Brownrigg highlights opportunity in China

in work with Stanford University professors and students

Stanford University Fall 2001 Seminar/Public Lecture Series

Topics in International Technology Management

29 Nov 01

For full release, see

http://asia.stanford.edu/events/fall01/slides/brownriggSlides/index.htm

|

|

In a slide presentation prepared for working with Stanford University

professors and students, Mr. Michael Brownrigg, ChinaVest partner,

chronicles China's historically repressive economic policies that were

accompanied by periodic famines. But Deng's liberalizing reforms dating to

1979 unleashed "startling" success. China's entry in the World Trade

Organization and its hosting the Olympics will likely spur further

progress. Challenges do remain, primarily banking, governance, legal

structures, and manpower. From a "macro" perspective, China has

experienced strong economic growth and a surge in foreign direct

investment, while at the

|

|

same time keeping foreign debt to a minimum. From a "micro" perspective,

Mr. Brownrigg speaks of the trust and family oriented business structures

found in China as compared with the law- and corporate-based relationships

found in other developed cultures. In addition to untapped consumer

markets, China is experiencing "dynamic growth" in its information

industry, "surging demand" for sophisticated distribution, and a "shift of

hi-tech manufacturing from Taiwan to China." He summarizes his

presentation by quoting The Economist (March 10, 2001) saying the

"most stunning economic event of the past century" is the economic growth

of China "since it opened up" in 1979.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

34. AsiaInfo reports on Q2; sees delays in China's telecom reorganization

AsiaInfo Holdings press release

23 Jul 02

For full release, see

http://biz.yahoo.com/bw/020723/230525_1.html

|

|

AsiaInfo Holdings (NASDAQ: ASIA)

reported second-quarter results for the period ended June 30 that showed

year-over-year and sequential gains. The company, the leading provider of

telecom network integration and software solutions in China, is expected

to benefit from the country's low penetration rates for fixed-line and

cell phones as well as renewed competition between China's two largest

telecom companies. China Telecom and China Netcom were split into separate

companies May 16, 2002, in a move

|

|

that is expected to lead to an upswing in spending as they respond to the

newly competitive environment (see citation #28). But the industry reorganization appears to

be taking longer than expected, so AsiaInfo management scaled back

near-term expectations while at the same time began instituting cost-cutting

measures. The firm's balance sheet is outstanding, but the earnings

release broke as world markets were in rapid decline, thus taking ASIA

shares to new lows and near book value. AsiaInfo Holdings is a portfolio

company of ChinaVest.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

33. Halcyon Software merges with Stryon; creates leader in

legacy application migration software and services

Stryon press release

18 Jun 02

For full release, see

www.stryon.com/company.asp?s=4

|

|

Stryon (www.stryon.com)

has merged with Halcyon Software. The new company will focus on developing

software that will help businesses move their older software, called

legacy software, to newer operating environments. The merged company,

retaining the name Stryon, is closely affiliated with The

CyberNET Group,

a global systems integration firm with operations

|

|

throughout North America, Europe, South

Africa, Asia, and Australia. CyberNET CEO Barton Watson comments, "The

merger with Halcyon brings tremendous capabilities to Stryon" as it "can

now provide a scope of application services never before available to

middle market companies and enterprise accounts." Halcyon is a portfolio

company of ChinaVest.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

32. Michael Brownrigg of ChinaVest co-authors report

on International Property Rights

Pacific Council on International Policy

Jan 1998

For full report, see

http://www.pacificcouncil.org/pdfs/Intellec.pdf

|

|

The Pacific Council on International Policy sponsored a study

group in 1998 that examined how the U.S. might best foster the development of

international property rights. Mr. Michael Brownrigg, then vice president

of ChinaVest, co-authored the final report. The 58-member group concluded

that a "cooperative public-private effort(s)" was needed not so much to

develop "dramatic new policy initiatives," but to ensure that existing

"international intellectual property

|

|

protections are promptly and fully implemented." The report includes 10

specific recommendations that generally revolve around the theme of a

cooperative public-private sector effort to champion the fundamental

benefits to all nations of protecting international property rights while

at the same time not shying away from aggressively, though judiciously,

using available legal remedies. Mr. Brownrigg is a partner at

ChinaVest.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

31. ChinaVest's Michael Brownrigg cites impact of

China's fast-changing economy on different age groups

Stanford University's Asia Technology Initiative 2001

2001

ATI Shanghai 2001 home site

http://stanford.edu/group/ssae/ati/shanghai

|

|

Mr. Michael Brownrigg, a ChinaVest partner, started his talk at ATI 2001 in

conjunction with ATI Shanghai 2001 with a short review of Chinese economic

history. He went on to address the different impact that the country's

history has had on three age groups, 70+, 40-50s, and 40 and under. The

latter group is generally the least affected by the country's storied past

and the |

|

most likely to embrace Western business

practices. Family ties, as contrasted with western corporate cultures,

continue to be important in China. As such, there remains a need to build strong

personal relationships with Chinese entrepreneurs. Mr. Brownrigg expanded

on ChinaVest's, the oldest venture capitalist firm in China, evolving

pattern of relationships in China.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

30. Robert Theleen speaks of China's "dynamic internal market."

Global Province

Jun 02

|

|

A "lack of ideas" from corporate America coexists with a

"vacuum in political thought, both in the United States and abroad."

According to William Dunk's

2002 Annual Report on Annual Reports. Against

this backdrop, "the very fact that the Chinese leadership is searching for

a new ideology is testimony to the refreshing and rather singular realism

with which it is confronting all its problems and opportunities." ChinaVest's chairman, Mr. Robert A. Theleen is quoted as |

|

saying, "The top echelon of this (Chinese) society knows where it has to

go and that surefootedness is radiating far and wide about the

countryside." Mr. Theleen states that China's newer "bottoms-up entrepreneurial style" will

be leveraged by the country's entry into the World Trade Organization and

its hosting of the Olympics to create "a more dynamic internal market

driven by consumer branding and a next-generation distribution system."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

29. eOn Communications earnings report reflects soft market but strong financials

eOn Communications press release

29 May 02

earnings release:

http://biz.yahoo.com/prnews/020529/atw018_1.html

|

|

Commenting,

"The signs of recovery in the US economy have not yet trickled down to the

market for communications products and services," eOn Communications

(Nasdaq: EONC) reported lower revenues and a loss for its third quarter of

fiscal 2002 ended April 30. During the quarter, the company signed up new

customers, including iVox LLC and Ansafone Communications, and won

follow-on business with NAV Canada, PETsMART, Circuit City Stores, and

Lillian Vernon. eOn also "signed an integration and reseller agreement

with N'ser Community" that will allow it "to address the

|

|

newly emerging multi-channel contact center solutions market in Korea,

China, Taiwan, Singapore and Indonesia." Troy Lynch, eOn's president and

chief executive officer, is reluctant to provide specific guidance for the

fiscal fourth quarter, but he has seen "some positive signs recently, and

we are encouraged by our increased pipeline activity." He expects a "modest

sequential improvement in revenues and earnings." The release reports the

company to have $0.83 per share of cash and marketable securities, and

the balance sheet shows no long-term debt. eOn Communications is a

portfolio company of ChinaVest.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

28. China Telecom breakup to spur demand for AsiaInfo's system-integration products

The Wall Street Journal; International

Section

In China Telecom Breakup, Opportunity Galore

16 May 02;

page A12; by Matt Pottinger

|

|

The Wall

Street Journal reporter Matt Pottinger reports on the "long-awaited

breakup of China Telecommunications." Following the breakup, China Telecom

will control "21 provinces in China's South and West," while China Netcom

Group "will control 10 provinces in the North." The split is expected to

kickoff a new wave of investment in software and equipment. Chief strategy

officer at AsiaInfo Holdings, Fan Bao,

|

|

believes that the breakup "will spur demand for new equipment and software

to provide call-waiting, voice-mail, short-messaging and Internet service

for China's 190 million fixed line customers." Mr. Pottinger notes that AsiaInfo is a Nasdaq-listed (ASIA) systems-integration company whose

biggest client is China Telecom. AsiaInfo Holdings is a portfolio company

of ChinaVest.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

27. Consumer borrowing creates "seismic" shift in

China's growth engine

The Economist; Finance & Economics

Asia's

consumers are at last starting to spend and borrow. A boon for Asia's

banks?

20 Apr 02;

pages 69-70

|

|

The Economist describes it as "a seismic shift in the region's economics,

banks and consumer patterns." An American investment banker calls it "the

single most powerful theme in Asian Financial services." They are talking

about an increasing willingness of Chinese consumers to borrow and of

Chinese banker's enthusiasm to lend. "And the trend is not confined to

plastic. Home mortgages, car loans, unsecured credit; all forms of

consumer finance are soaring, albeit from a small base." This

|

|

shift toward consumerism stands in contrast with the "the export-led

development . . . based on high rates of saving and investment" model of

recent decades. While not without infrastructure challenges, China's savings

rate of 40% -- one of the highest in the world -- and falling cultural

barriers toward borrowing should continue to fuel the rapid growth in

outstanding consumer loans. ChinaVest has an investment interest in Prime

Credit, a Hong Kong-based financial services company.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

26. "Wondrous Impatience" triggered twenty years of

near double-digit growth; but the strategies for success in China are shifting

A Speech by

Robert A. Theleen, Chairman, ChinaVest, Inc.

"Wondrous

Impatience; A Twenty-Year Perspective on Investing in China"

13 Apr 02

for entire text

of speech, see:

http://www.globalprovince.com/chinavest/4.13.02.htm

|

|

In a

speech to "the most distinguished and knowledgeable gathering of

scholars, of business men and women, and of members of government of the

entire Asia-Pacific Region," ChinaVest's Chairman, Mr. Robert A. Theleen,

follows "investment flows" in order to help explain why "China has been

so successful in developing investment capital over the past twenty

years." The gathering took place at the BOAO Forum For Asia 2002 Annual

Conference held in Hainan, China. Mr. Theleen draws on his roughly 25

year experience, including the founding of ChinaVest in 1982 as the

"first American private equity investment fund dedicated to China," to

articulate the "micro economic and political events" that produced "one

of the most massive and continuous flows of capital into any country in

modern history."

Mr.

Theleen attributes the speed with which China has evolved -- twenty years

of near double digit growth -- to "wondrous impatience," the development

of an "ad hoc" decision making process "which ensured that infrastructure

needs and bureaucratic processes did not interfere in GDP growth."

Specifically, he cites an "unspoken covenant between government officials

. . . and the overseas Chinese entrepreneur;" China's willingness "to

import foreign legal systems;" a recognition "that a stable currency was

key to growth and economic confidence;" and "the freedom of the consumer

to choose." As a result,

|

|

foreign

direct investment (FDI) in China was tens times that of Japan over the

last ten years, and, "at the end of 2001, FDI in China totaled more than

$50 billion, approximately 25% of the world's total FDI."

Looking

forward, Mr. Theleen reports that he's seen evidence that China's entry

into the World Trade Organization "is already accelerating investment

and capital flows into China." And he feels that the Beijing Olympics of

2008 could well usher China into the international community as the

Olympics of 1964 and 1988 did for Japan and Korea, respectively.

Noting

that "those who have had less than spectacular returns in China find

themselves caught up with yesterday's assumptions rather than today's

realities," ChinaVest is "looking at alternative sources of finance to

supply to the changing scene of China's financial needs." In the 1980s

China was a producer; then in the 1990s it turned to consumerism; and in

the late 1990s China became a participant in technology, IT,

electronics, and telecom. Today, ChinaVest has built its "strategy on

the concept of the Chinese economy moving from the vertical to the

horizontal." But more importantly, the firm's "bet is, as it has been

for the past 25 years, on the Chinese entrepreneur, no longer the

overseas version. But the 2002 model -- highly educated, at home and

abroad, highly motivated to succeed, like his overseas cousin, and very

well poised to develop the network of relationships in and out of China

as this economy continues to shine."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

25. AsiaInfo Holdings' first quarter operating profit driven by high-margin software and services

AsiaInfo press release

24 Apr 02

earnings release:

http://biz.yahoo.com/bw/020424/240478_1.html

|

|

Commenting

that he continues "to see the positive impact of our long-term strategy

as a full service telecom provider," Mr. James Ding, AsiaInfo's (Nasdaq:

ASIA) President and CEO,

comments that, "We are very pleased with AsiaInfo's results this

quarter." For its first quarter of 2002 ended March 31, the company

posted a "higher than expected operating profit of US$1.1 million,

significantly higher than the company's loss of US$23,000 a year ago."

After adjusting for the cost of hardware, net revenue rose 20% over the

year-earlier quarter to US$17.1 million. The net revenue backlog rose

16% over the prior year and was flat on a sequential basis despite a

traditionally slow first quarter. The recent

|

|

acquisition of Bonson Information Technology "confirmed our position as a clear leader in

telecom operation support systems (OSS) solutions." A number of new contracts with a

particular interest in OSS were announced in the first quarter, including contracts with China

Netcom, China Mobile subsidiary and Guangzi Mobile, China Railcom, Shanghai Mobile, and Shanzi Mobile.

Going forward, AsiaInfo is expecting second quarter results to reflect year-over-year net-revenue and

operating-income gains of 20% and 42-44%, respectively. Net income is projected to come

in between $0.07 - $0.08 per basic share. AsiaInfo Holdings is a portfolio company of ChinaVest. AsiaInfo

Holdings is a portfolio company of ChinaVest.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

24. ChinaVest moves offices to historic Bund

Company sources

01 Mar 02

|

|

ChinaVest has moved its

Shanghai Headquarters to one of the most venerable buildings on the

Bund, considered by some to be among the most spectacular streets in all

of Asia during the days of Old Shanghai. The building once housed the

Shanghai headquarters of the Hongkong and Shanghai Banking Corporation,

and at sundry times the building has housed parts of the Shanghai

Municipal Government. Today it is called the Pudong Development Bank

building. The building, its architecture a blend of art nouveau and art

deco, remains a pillar of

|

|

endurance

and a key financial link to the growing Chinese market. Since its

construction in 1925, the building has served as a center for vibrant

commercial activity for which Shanghai, China's New York City, is so

well known. The new address is:

Suite 336 Bund Building

No. 12 Zhong Shan Dong Yi Road

Shanghai 200002

For more on this historic building, click

http://www.talesofoldchina.com/shanghai/t-bank01.htm

For more on the historic Bund, click

http://www.sh.com/arch/archch2.htm

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

23. Some ChinaVest portfolio companies

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

22. From thousands of worldwide venture capitalists,

Forbes spotlights ChinaVest

as one of 50 active firms

Forbes.com

01 Apr 02

|

|

In an

April 1 piece titled "The money list," Forbes lists a group of 50

venture capitalists that it selected "from the thousands of venture

capitalists in the world." Forbes also lists some of each firm's "better

know deals." ChinaVest is further

|

|

recognized by its focus on the Asian market. Among its better know

deals, Forbes lists Asia Info Holdings (Nasdaq:

ASIA), Virgin Atlantic, and

Zindart (Nasdaq: ZNDT). For the

entire Forbes.com listing,

click here. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

21. China's large, skilled labor pool draws continued manufacturing

investment, even in high technologies

The Wall Street Journal; page A1; by Peter Wonacott

14 Mar 02

|

|

Mr. Peter

Wonacott reports that, attracted by an abundance of cheap but

increasingly skilled labor, "Foreign direct investment in China last

year totaled $46.8 billion, . . . up 15% from 2000." The supply of

skilled workers is being fueled by China's vocational schools "offering

more engineering classes" and by universities "where 37% of graduates in

2000 were engineers." And though demand for skilled workers is on the

rise, some foreign investors believe that wages will remain favorable

for another 10 years. "The decisive factor is the pool of labor." Mr. Wonacott points out that, "For many, the opportunities in coastal areas

favored by foreign investors and bolstered by economic reforms are

|

|

a step up

no matter how low the wages."

The

advantages of a large and growing pool of low-cost, skilled labor

applies not only in toys and less complex manufacturing but also in a

broad range of high technology products. In some cases, the low labor

costs make China one of the most profitable "countries in which (to)

operate." This is attracting investment by multinational corporations:

Motorola along with its partners and suppliers plans to invest $6.6

billion over five years; Japan's Hitachi will increase its already

substantial investment by another $800 million over five years; and

Intel plans to double its Shanghai investment by spending $302 million.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

20. Goldman Sachs putting up to $1 billion of private equity in Asia,

even as other institutions pull out

The Wall Street Journal; Deals & Deal Makers Section; page

C16; by Henny Sender

12 Mar 02

|

|

Henny

Sender reports that while California's public-employee pension fund,

Calpers, is pulling out of Asia, Goldman Sachs is returning to the

region by "putting up as much as $1 billion in new private equity money

for Asia." The money is "part of a new $5.25 billion fund that Goldman

recently raised." Goldman Managing Director

|

|

Henry Cornell, who led the firm to a string of successful Asian investments in the mid-1990s, is returning to oversee

the firm's new investments. He will be targeting "stakes in traditional

businesses," particularly non-technology. ChinaVest focuses on Greater China,

roughly encompassing those parts of Asia with a substantial Chinese business community.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

19. SurfMonkey transforms to fee-based web-filtering

service for kids

Investor's Business Daily; Internet & Technology Section; page A7; by Pete Barlas

5 Mar 02

|

|

Pete

Barlas chronicles SurfMonkey's evolution from a free, ad-supported kid's

content site to a fee-based Web-filtering service for kids. The firm's

browser-based service prevents children from accessing adult-content web

sites as well as blocking unauthorized "visitors from contacting

children through electronic mail or chat rooms." To market its product,

SurfMonkey took "an unusual tack" by selling its product "through

partnerships with Internet service providers (ISP)." To date, the

company has landed contracts with EarthLink in the U.S., British

Telecommunications' BTopenworld, and Japan-

|

|

based NTT Communications. Customers, about 5,000 in each market, pay

$3.95 a month that SurfMonkey splits with the ISP. EarthLink chose

SurfMonkey in order to save money while it competes with its biggest

rival, AOL. Arley Baker, an EarthLink spokesman, states, "We looked for

the best-of-breed technology so we don't have to build our own

applications." SurfMonkey's CEO, Charles Hart, "expects SurfMonkey to

have up to 500,000 subscribers worldwide by the end of the year."

ChinaVest has an investment position in SurfMonkey. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

18. eOn Communications, "encouraged by the level of renewed activity,"

reports fiscal second-quarter results

eOn

Communications press release

28 Feb 02

http://biz.yahoo.com/prnews/020228/atth021_1.html

|

|

eOn

Communications (Nasdaq; EONC) announced fiscal second-quarter results.

Revenues were crimped by seasonal weakness in the firm's contact center

business and general economic weakness that led to extended sales cycles.

Looking forward, management is "encouraged by the level of renewed

activity among our customers and prospects for deploying contact center

solutions," particularly, "The need for call centers to convert to

multi-media contact centers is greater today than it has ever been." The

bottom line improved, as evidenced by an $0.11 per-share loss versus a

loss of $0.44 in the year-ago period. The balance sheet shows more than

$11 million in cash and marketable securities and no long-term debt.

During the

quarter, eOn booked new business |

|

from

existing customers, expanded its partnerships and alliances, launched a

new Millennium Partner Program to deliver new products and services to

preferred partners, and "added three new channel partners to resell the

eQueue Multi-Media Contact Center Solutions and Millennium

Digital Communications Platform." Five awards were received during the

quarter, including "one of only 15 Product of the Year Awards from

Communications Convergence magazine for the eQueue." And appropriate

forms were submitted to the Securities & Exchange Commission for the

pending spin-off of the company's wholly owned Caribbean/Latin America

service and distribution subsidiary, Cortelco. eOn Communications is a

portfolio company of ChinaVest. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

17.

Important links for business leaders along the Pacific Rim

The following is a list of

sites that will be useful to those engaged in commerce between Great

China and the United States. Many more links will be added in the

future.

|

|

Asia-Links

Asia-Links serves as a

bridge between Asia, the U.S., and Europe by providing information,

technology and eCommerce services for the electronics and high tech

industries.

asia

money.com

The home of Asiamoney

magazine, including editorials by the asiamoney.com team and special

community sections that draw together relevant content from across all

the international finance titles of Asiamoney's parent company,

Euromoney Institutional Investor PLC, as well as selected third-party

sources and sponsors.

Council On Foreign Relations

Founded in 1921, the Council

on Foreign Relations is a nonpartisan membership organization, research

center, and publisher dedicated to increasing America's understanding of

the world and contributing ideas to U.S. foreign policy. The Council

accomplishes this mainly by promoting constructive discussions both in

private and in public, and by publishing Foreign Affairs, the leading

journal on global issues.

The Asia Foundation

Utilizing its

47-year presence throughout Asia, The Asia Foundation collaborates with

partners from the public and private sectors to build leadership,

improve policy and regulation, and strengthen institutions to foster

greater openness and shared prosperity in the Asia Pacific region.

|

|

The Center For The Pacific Rim

Recognizing the San

Francisco Bay Area as the pre-eminent American gateway to the Pacific,

the Center promotes understanding, communication, and cooperation among

the nations, peoples, and economies of the Pacific Rim through academic

degree programs, public events, publications, research, and scholarly

exchange.

SINA.com

SINA is a leading Internet

media and services company for Chinese communities worldwide, offering

global Chinese-language content, commerce and community services to four

localized Web sites targeting China, Hong Kong, Taiwan, and overseas

Chinese in North America.

Singapore Venture Capital Association

The Singapore Venture Capital

Association was formed in 1992 under the patronage of the Economic

Development Board to promote and foster the growth in venture capital

and private equity within Singapore's financial services industry. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

16. U.S. News and World Report examines

China's key role in world economy

U.S.News & World Report

11 Feb 02; page 42; by Joshua Kurlantzick

http://www.usnews.com/usnews/issue/020211/biztech/11china.htm

|

|

U.S.News & World Report spotlights Globalism in its Money & Business

Section. In The China Question, Joshua Kurlantzick takes a close

look at the risks and opportunities in China. While recognizing that a

"massive divide between high-tech Hangzhou and low-rent Yunnan"

evidences "cracks" in China's "gold-plated surface of the bustling

coastal cities," the author goes on to make the case that at least "for

now, the enormous wealth disparities within China actually |

|

benefit

the country's economy." Issues of privatization, financial regulations, and developing

capital markets will all have to be managed adroitly, but "most foreign

business people believe the Middle Kingdom will mature into a

responsible trading partner." Jun Zhao, vice president of ChinaVest,

comments, "Other than America, China is the only real continental

economy in the world, with huge varieties in salaries" which "puts it in

a league apart from countries like Taiwan or even Japan." |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

15. Speeches by Robert Theleen,

ChinaVest Chairman

|

|

The following is a partial list of some of the more recent speeches by

Robert Theleen before sundry organizations concerned with Asian business

and American-Asian affairs.

2002 April

BOAO FORUM FOR ASIA 2002 ANNUAL CONFERENCE

http://www.globalprovince.com/chinavest/4.13.02.htm

2001 November

2001 Asian Venture Forum

www.asianfn.com/conferences/conference_login.asp?strConference=20011114

www.asianfn.com/conferences/conference_past.asp

2001 August

Singapore Venture Capital Association

www.svca.org.sg/events/r-archives.htm

2001 May

IFC Global Private Equity Conference

www.ifc.org/funds/pdfs/robert_theleen.pdf

2001 April

Pacific Council on International Policy

www.pacificcouncil.org/public/Events/2001.html

2000 October

Pacific Council on International Policy

www.pacificcouncil.org/public/Events/2000.html

1999 December

Council on Foreign

Relations -- cosponsored with Pacific Council on International Policy

chaired study group

www.cfr.org/Public/resource.cgi?meet!1883

1998 November

UC Berkeley's Center For Chinese Studies

www.haas.berkeley.edu/~haasweek/98fall/981123/headlines/newswire.html

1998 April

World Affairs Council

www.wacsf.org/calendar/9804cal.htm

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

14. AsiaInfo

Holdings reports financial results and

moves, via acquisition, to number one position in key

Chinese wireless market

Company press releases

22 Jan 02

financial results:

biz.yahoo.com/bw/020122/220544_1.html

acquisition:

biz.yahoo.com/bw/020122/220540_1.html

|

|

AsiaInfo Holdings (Nasdaq;

ASIA) announced fourth-quarter and year-end results for the periods

ending 31 Dec 01. The company "continued to demonstrate strong growth in

the fourth quarter" by reporting record operating profits and net

income. The US$4.3 million in net income exceeded analysts' average

expectation of US$3.83 million. Management expects the momentum to continue, as they are

projecting a 70% jump in operating profit for 2002. The release

spotlights the announcement of six new contracts and the release of two

new software products during the quarter. Mr. Ding, President and CEO of AsiaInfo, comments, "With a full suite of telecom software solutions and

an extensive customer installation base, AsiaInfo is best positioned to

help China's telecom carriers succeed" in an "increasingly |

|

competitive" telecom market. AsiaMoney,

a leading financial magazine, named AsiaInfo as "one of China's Best

Managed Companies."

In a separate release, AsiaInfo announced its

plans to acquire Guangzhou-based Bonson Information Technology for $47.3

million in cash and stock. Bonson provides "telecoms operations support

systems used to run communications networks in China." Its "main

customer is China Mobile," the mainland's biggest cellular carrier. The

acquisition of Bonson will vault "AsiaInfo to undisputed number one

position in the wireless BOSS (telecom operation support systems) market

in China." It is expected that the acquisition will be immediately

accretive, adding 8-10 cents to 2002 earnings per share. AsiaInfo

Holdings is a portfolio company of ChinaVest. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

13. The Asia Foundation

spotlights America's role in the rapidly developing Asian marketplace

The Asia Foundation

copyright 2001

www.asiafoundation.org/publications/rpt_amer.html

|

|

Fastest

growing, vital, profound, positive trends, market economy, liberalization, and democratization all come from a task-force

report that was commissioned by The Asia Foundation in early 2000 and

published in 2001. The task force was commissioned to examine "the

challenges facing the United States in Asia and to recommend policy

initiatives for the new administration and Congress." Mr. Robert Theleen,

Chairman of ChinaVest and Trustee of The Asia Foundation, participated

in the study. In

addition to spotlighting the enormous growth in U.S. private equity in

Asia -- going from $300 million to $400 Billion in 20 years -- the |

|

report presciently speaks of the need to be

"involved in preventing the India-Pakistan dispute from escalating into

armed, even nuclear, conflict." It also speaks of the need to "Take a

more active role in helping to resolve the Kashmir and Afghan disputes."

An executive summary reviews six "Trends that could threaten U.S.

interests;" three "Trends that could support U.S. Interests;" and 13

summary "Recommendations."

For a list of members of the "America's Role in Asia," click here:

task force members

To order "America's Role in Asia" from the Brookings Institution for

US$10.95, please click here:

order |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

12. Stream Machine, a

ChinaVest portfolio company, is acquired by Cirrus Logic

Cirrus

Logic press release

10 Dec 01

www.cirrus.com/press/news/index.cfm?CategoryID=2&CategoryName=Corporate&SubcategoryID=11&NewsID=248

|

|

Cirrus Logic, "the premier

supplier of high-performance analog and DSP chip solutions for consumer

entertainment electronics," completed the acquisition of Stream Machine.

Stream Machine is "a leading supplier of MPEG-2 video recording

technology." The firm's "proprietary video-compression technology

provides high quality video for multiple home entertainment

applications, such as DVD recorders, personal video recorders, digital

camcorders and PC video peripherals." Cirrus |

|

Logic's

web site describes ChinaVest as being a "Major Investor" in the company.

ChinaVest is a venture-capital firm providing "long term investment

capital and management experience to growing companies doing business in

or with China, Hong Kong and Taiwan" Other investors included the

Mayfield Fund, Tallwood Venture Capital, Vertex Management (II) Pte.

Ltd., Bessemer Venture Partners, and the WI Harper Group. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

11. ServGate, a ChinaVest portfolio company,

secures $8.6 million in development funding

ServGate Technologies press release

30 Nov 01

www.servgate.com/press/releases/20011130.htm

|

|

ServGate Technologies announced that it has received $8.6 million in

development funding from a group "led by ChinaVest, a San Francisco

and Beijing-based venture capital firm overseeing more than $300

million in investments." Other investors include Kingston

Technologies and Pac-Link. ServGate's flagship product, the SG2000

is a high-performance security gateway considered to be the "world's

fastest firewall."

See

www.servgate.com/products/sg2000/benchmarks.htm

for additional product details.

"ChinaVest

invests in high-growth companies who do business in Greater China or who

wish to introduce their products to the Chinese market."

ServGate

will use the money for product

|

|

development and for building "a worldwide sales and support

organization." Michael Brownrigg, Vice President and Partner of

ChinaVest, comments that ServGate has "a huge opportunity in China

and throughout Asia (because) most enterprises are under-secured."

He further believes the firm's "superfast service provider-level

security gateways are perfect for very high bandwidth users and

network operators in North America and Europe." Dr. Rick Schaffzin,

President and CEO of ServGate, states, "This level of funding

enables us to maintain our high rate of growth, deliver our products

to market, continue development of our next-generation platforms,

and build the sales and customer service arms needed to support the

demanding base of leading enterprises and service providers."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

10. AsiaInfo Holdings, a

ChinaVest portfolio company, mentioned in article on China's evolving

equity markets

Wall Street Journal;

page C1; by Craig Karmin and Karby Leggett

09 Nov 01

|

|

While

risks remain, WSJ staff reporters highlight the progress being made

toward liberalizing China's equity markets. Private companies

continue to face obstacles accessing the equity markets, including

"the communist party's lingering ambivalence toward the private

sector," but they are finding it increasingly easier to tap the

market for funds. They still fall short of their economic

contribution -- "private companies now account for nearly half of

China's economic output" -- but "in the past two years, the Chinese

government has begun allowing private companies to go public." Some

fund managers consider this small |

|

cadre of

companies, such as Nasdaq-listed AsiaInfo Holdings (ASIA), to "offer a unique opportunity for U.S.

investors who are hungry to gain exposure to China's giant economy

but have been reluctant to sink their money into poorly managed

state-run companies." While China's entry into the World Trade

Organization might well provide further impetus to privatization,

pressures remain on regulators to give priority to state-run firms.

"So more of China's fastest-growing private firms are turning to

overseas markets for investment, giving foreign investors at last a

chance to cash in on China's economic re-emergence." |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

9. Investing in growing Chinese market; follow the lead of Global

Companies

time.com; by Daniel Kadlec

25 Oct 01

www.time.com/time/global/october2/investing.html

|

|

While acknowledging the

volatility of Chinese stocks (B shares open to foreign investment

fell 34% since May but have tripled in four months and are up 73%

year to date), David Kadlec focuses on the "huge long-term promise"

of investing in China. China's economy is "growing 7% annually"

without inflation, and its about to get more attention by virtue of

entering the World Trade Organization and hosting the 2008 Olympics.

William Dunk, a

Dallas-based management consultant, is quoted as saying, "If you're

serious about growing, you've got be there." He argues that it would

behoove investors to follow the lead of major U.S. corporations that

are committed to China, including Coca-Cola, GM, IBM,

Motorola, and Proctor & Gamble. Robert Theleen, who's been

investing in China for |

|

20 years through his venture capital firm ChinaVest, goes further to pint out that" China

is Kodak's second-largest market for film and will probably be No. 1

within a year or two." He believes "The big story now is the

emerging domestic service economy that will set China apart from

other Asian economies. Manufacturing, mainly for export, is well

developed throughout Asia."

Mr. Kadlec suggests that

individual investors go slowly despite "Chinese regulators cracking

down" on manipulative trading practices, as China's capital markets

"are underdeveloped; disclosure requirements and investor

protections are shoddy; and the rules are baffling." He recommends

investors look to global consumer products companies, mutual funds

targeting China, ADRs of Chinese companies trading in the U.S., and

for the more aggressive, direct investment in Chinese B shares. |

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

8. ChinaVest Considering New Asian Venture-Capital Fund

Venturewire.com

03 Oct 01

|

|

Venturewire.com reported today that ChinaVest is considering creating

its sixth venture-capital fund. According to the firm's Vice President,

Michael G. Brownrigg, ChinaVest is considering targeting Asian-market

investments "in logistics, IT, and media, and could possibly extend into

healthcare services."

The company has deployed about two thirds of

|

|

the $100 million that it raised in its fifth fund during 1998. While remaining "cautious," ChinaVest recently invested $5 million

in Virgin Radio Asia, a provider of FM radio throughout Asia. Overall, ChinaVest manages over

$300 million. Other recent investments include NewTone Communications, a telecommunications

provider, Serve Gate, a provider of firewall applications, and Sheik Logistics.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

7. Alpha-Top merges with Tiawan-based Elitegroup

Reuters English News Service

14 Aug 01

|

|

At a time that companies are finding it strategically advantageous

to maintain their competitive edge via mergers and acquisitions, it

was reported today that Elitegroup, a Taiwanese-based maker of

motherboards, announced its intention to acquire the nearly 80% of

unlisted Alpha-Top

|

|

that it doesn't currently own. The

acquisition calls for Elitegroup to exchange one Elitegroup share

for each 3.5 Alpha-Top shares in a deal worth US$179 million. The

merger is to take effect December 15. ChinaVest has an investment position in Alpha-Top.

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

6. ChinaVest teams with Sir Richard Branson to create Virgin Radio (Asia) Limited

Virgin Group release

26 Jun 01

www.virginradio.co.uk/onair/vrnews/jun03_asia.htm

|

|

It was announced today that ChinaVest has

agreed to take a stake of up to 25% in Virgin Radio (Asia) Limited,

a network of Virgin FM radio stations throughout Asia. Robert

Theleen, Chairman and Founder of ChinaVest will join the new firm's

board of directors. Discussions are "already underway for the

company to acquire equity interests and management control in

existing radio stations in several Asian markets, including Hong

Kong SAR, Singapore, Taiwan, The People's Republic of China,

Thailand and India." The new concern will initially focus on

|

|

"Greater China, Thailand and India, ultimately establishing a

presence throughout Asia, excluding Japan." Sir Richard Branson,

Founder and Chairman of the Virgin Group of companies, including the

"UK('s) arguably . . . most relevant radio brand and one of the

largest national commercial radio stations in the UK," is "thrilled

to be joined by Bob Theleen and his team from ChinaVest. Their 16

years of investing in Greater China and relationships will certainly

help us in our understanding of the needs of these exciting

markets."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

5. ChinaVest emphasizes Chinese logistics at Global Private Equity Conference

International Finance Corporation's Global Private Equity Conference

09-11 May 01

http://www.ifc.org/funds/pdfs/robert_theleen.pdf

|

|

In a presentation to the IFC Global Private

Equity Conference last May, Mr. Robert Theleen, Chairman of ChinaVest,

laid out ChinaVest's positioning in a segment titled "Emerging

Industries: Coming soon to a market near you?" After reviewing China's

economic trends, including a 9.3% real annual growth rate and a

quadrupling of per-capita income since 1978, Mr. Theleen spotlighted

seven industries driving China's growth: automotive, pharmaceuticals,

cosmetics, textiles, telecom, technology, and

|

|

consumer goods. The historical logistical challenges of investing in

China were addressed, as were signs of China's improvements. ChinaVest's

strategy for capitalizing on China's opportunities is to build a brand

name "as the leading fully integrated logistics investor." They plan to

"build a professional logistics team combining local talents with

western supply chain management methods." And "build a nationwide

service network with fully integrated information system."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

4. ChinaVest profiled by CyberLabs Research

CyberLabs Research

http://www.cyberlabsresearch.com/profile/ChinaVest.html

|

|

In a profile piece, CyberLabs Research overviews ChinaVest's

strategy of investing in "growing companies doing business in or

with China, Hong Kong, and Taiwan." ChinaVest has

|

|

invested in a range of companies, believing that its

"collective business and financial experience in Asia and the United

States gives (the firm's) portfolio companies an operational

advantage in the market."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

3. ChinaVest Pioneers Greater China

Thedailydeal.com; by Shu-Ching Jean Chen

12 Apr 01

www.thedeal.com

|

|

Quoting ChinaVest Fund managers, Shu-Ching Jean Chen writes that

ChinaVest is "the first independent venture capital fund operating

in China that is not affiliated with a bank, the first buyout firm

in the greater China region and the first private equity investor in

China. It is also one of the very few venture capitalists that focus

on investing in China-related ventures." The firm's first Chinese

venture in 1986 was also "the first foreign transport joint venture

ever struck in China." ChinaVest sold its investment in Santa Fe

International two years later to reap "an internal rate of return of

142%." The company has since invested in a number of

"transportation-related investments in China, including warehousing

company CV Transportation Services, household goods and freight

forwarding company Global Transport and consumer goods distributor

Tait Asia."

Since

1985, ChinaVest has closed five funds "worth more than $300 million

and invested in more than 40 companies." Shu-Ching Jean Chen

chronicles the firm's evolution from the early 1980s when Robert A.

Theleen and Patrick L. Keen, colleagues at First National Bank of

Dallas, formed Dallas Pacific Group. In 1984, they recruited Dennis

Smith and changed the name to ChinaVest. The partnership expanded in

the 1990s to include Alexander M.K. Ngan, founder of Zindart Ltd.

which ChinaVest took public on the Nasdaq in 1997; Michael Bownrigg,

the former U.S. trade representative to Hong Kong; Monique Lau, "a

corporate credit

|

|

banker with Citibank and Bankers Trust; Jenny Hsui, a seasoned China trader; and Edward B.

Collins, formerly a partner and greater China legal adviser with law

firm McCutchen, Doyle, Brown & Enersen llp."

According to Lau, ChinaVest's success has been keyed to singling

"out up-and-coming Chinese entrepreneurs." For example, Asia Info

Holdings was founded by young Chinese students in the U.S. and

debuted on the Nasdaq in March 2000. It has "captured 70% of the

Chinese Internet infrastructure market." Lau goes on to describe

"two patterns of investment that ChinaVest has long orchestrated."

One "involves assuming a controlling stake, and jump-starting a

restructuring process." And the other "is to invest in growth

companies in an early stage." In the latter, ChinaVest avoids a

controlling stake so as to preserve "the incentives of the founding

entrepreneurs."

ChinaVest has staked out positions "from light manufacturing to

information technology to consumer goods." A notable investment

includes "Shenzhen-listed Luks Industrial, a television

manufacturer" from which ChinaVest was able to achieve "an internal

rate of return of 34% five years later after Luks went public in

Hong Kong." ChinaVest seeks two exit strategies, a conventional

public offering or a trade sale by which they sell out to an

interested buyer. While not without setbacks, notably a total loss

of its investment in Hong Kong's largest video store chain, Lau

states, "If you look around VC industry, and look at us, it's an

incredible record."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

2. High Technology Development Fourth Wave of Foreign Investment in China

IDG News Service; Hong Kong Bureau

08 Dec 99

www.idg.net/idgns/1999/12/08/MotorolaChinaTeamUpOn3G.shtml

|

|

In furthering a trend that Robert

Theleen, co-founder and chairman of ChinaVest, a U.S. venture

capital firm, describes as "the latest of four major waves of

foreign business in China since 1979," Motorola has announced

that it will work in conjunction with China's Research Institute

of Telecommunications Transmission

|

|

in an effort to "better understand what the Chinese market demands from 3G

wireless networks and devices." Commenting to attendees at a seminar organized by the

California-Southeast Asia Business Council, Mr. Theleen points

out that, "A growing pool of world-class technical talent now

exists in China's universities and research institutes."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|

|

1. ChinaVest Taps Entrepreneurs To Capitalize On Greater China

Forbes; by Andrew Tanzer

03 Aug 92

|

|

In an

article titled "Greater China, greater profits," Andrew Tanzer turns

the spotlight on Robert Theleen, Chairman and cofounder of

ChinaVest. ChinaVest has achieved "compound annual returns of 30%,

28%, and 26% on (its) three investment pools" by "investing with

entrepreneurs in Greater China . . . 120 million Chinese

encompassing Taiwan, Hong Kong and China's two southern provinces of

Guangdong and Fujian." The economy of the southern area of Guangdong

province, known as the Pearl River Delta, "is expanding by 20% a

year; personal incomes in that region of 20 million people have

swelled an astonishing tenfold since the late 1970s."

Drawing on his experience in military intelligence during the

Vietnam War and later as a banker in Singapore and Hong Kong, Robert

Theleen avoided the mistake of focusing on Beijing that large

American firms made when they rushed into the Chinese market in the

early 1980s. He, instead, invested with "Hong Kong Chinese

businessmen who were being pinched by rising

|

|

costs in Hong Kong and who looked for cheaper labor just across the border, in Guangdong."

His

first fund established in 1985 focused mainly on "Hong Kong

companies moving production of goods such as TV sets, videocassettes

and electronic components to China." A second fund was launched in

late 1987. Robert Theleen and ChinaVest sought to capitalize on an

expected increase in Taiwanese spending due to Taiwan's increasing

wealth and declining import barriers. The firm's third fund was

launched in mid 1989. Here, ChinaVest focused on Taiwanese

entrepreneurs investing in mainland China and U.S.-based Chinese

entrepreneurs. Mr. Theleen has begun to steer ChinaVest's third fund

"to southern China's consumer goods sector."

Mr.

Tanzer describes ChinaVest's strategy as investing in "middle-stage

venture capitalists, typically selecting already profitable

companies with sales of $10 million to $50 million as targets. The

investment often takes the form of debt carrying a below-prime

coupon and convertible into 10% to 40% of a company's common

shares."

|

|

return to top of Briefs

--

return to top of this page

--

return to globalprovince.com

|